Marriage resource is the most those things one has actually involved people upwards later in the day . Wedding receptions are going to be costly and if you are experiencing specific fear of exactly how it is possible to purchase yours, you will be not alone.

An average American relationship will cost you more than $29,one hundred thousand . Which is a good amount of parmesan cheese. Of numerous lovers seek out marriage finance to aid shoulder the burden. If you find yourself that is one method to go, it’s not usually the best option, and it is most certainly not alone.

Summary: you don’t need to enter into personal debt in order to wed. There are many different options available to choose from, and it’s important to envision everyone.

Advantages and disadvantages out of Matrimony Loans

Taking out fully a loan to pay for your wedding day is an effective piece of a double-edged blade. It could be a viable option for certain people, however, look out for taking on any the latest obligations which you can’t afford to settle inside the a good amount of time.

First, there’s absolutely no eg material since the good « marriage financing. » When you to definitely covers taking a marriage loan, whatever they really imply is a personal bank loan, which they will then use to pay for its matrimony. There are numerous reasons why people accomplish that, but you can find prospective drawbacks as well.

Advantages of Matrimony Finance

The main benefit of taking right out an unsecured loan to pay for the relationships would be the fact it’s a fast, simpler supply of funds. Of numerous relationship companies and venues assume a right up-front side deposit, and you may a marriage financing offers immediate access so you’re able to bucks to own those individuals down-payments. Bringing financing is also easier than you might envision. Many loan providers enables you to make an application for personal loans online, together with app procedure usually can end up being completed in an issue regarding times.

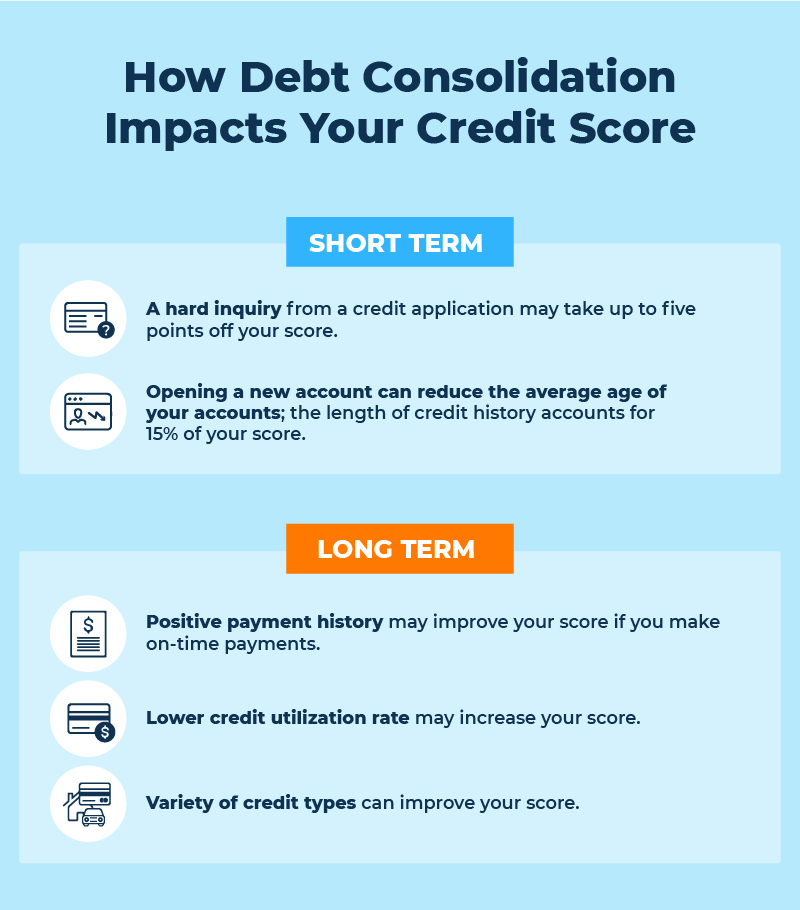

Another possible advantage worth taking into consideration is the fact a personal bank loan commonly has a reduced rate of interest than just a charge card. So if you want to avoid taking overcome inside borrowing from the bank card obligations, a wedding mortgage is a possible solution. In many cases, taking right out financing and you can purchasing they into a timely trend may actually change your credit rating.

Disadvantages out of Marriage Finance

The biggest downside out-of a marriage mortgage are an obvious one to: focus. Even although you make your costs timely, you’ll at some point wind up repaying a lot more that you borrowed. you will getting creating your own relationships with debt, and that’s not a thing extremely people should do. That have a preexisting mortgage may allow it to be more difficult to help you score a supplementary financing until its paid off. Eg, if you plan toward to buy a property or vehicles throughout the near future, your wedding day loan can make you to definitely difficult.

Never ever deal with people expense you simply cannot afford. Whenever you are being unsure of about your ability to pay-off a loan, then chances are you very should not take one to away. It is as simple as one to.

Relationship Financial support Alternatives

If you love to prevent taking out fully an unsecured loan so you can finance your wedding, then you’re lucky. A variety of alternatives for matrimony funding are available, and would also like to consider examining a way to slash down the cost of the special day.

1. Shell out that have a charge card

For most people, purchasing your wedding having a credit card is not good suggestion. It simply just work when you yourself have a healthier type of borrowing, and also the capability to lower your credit debt rapidly. If you find yourself thinking about setting up a special credit line to pay for your wedding day, extremely monetary advisers would suggest Larkspur CO no credit check loans your end you to.

dos. Crowdfund Your wedding day

Begin by talking to moms and dads and you will grandparents precisely how they may be able to help. Additionally, it is worthwhile considering asking for money in lieu of wedding gift suggestions and you may a married relationship registry . The nearest family and friends will likely be happy to lead economically towards the big day in lieu of to buy gifts. Or, as opposed to asking for all your family members to help pay money for the fresh matrimony and you will potentially perception obligated to go after their the idea, once they inquire whatever they can get you since the something special, require cash! Money is always high since you may put it to use but you need!

step three. Wait and you can Help save

For almost all couples, this is basically the best choice. Enjoy an extended engagement months and employ the extra time for you strive and you will cut normally money as you are able to. Even though you nevertheless finish taking right out financing, it would be a smaller you to and you will shell out they out of more easily.

cuatro. Downsize Your wedding day

An inferior relationships isn’t necessarily a detrimental issue. Mini wedding parties are a greatest development on the wake off COVID-19, and lots of people have ended right up protecting lots of money of the thought smaller weddings that have fewer travelers.

5. Finances Cautiously

It’s important to know the way far for every part of your wedding will set you back, to help you learn to skinny your financial allowance . For most couples, the wedding venue is the unmarried prominent debts, charging between $a dozen,100000 and you may $fourteen,100 normally. Because of the opting for a backyard relationships otherwise old-fashioned barn relationship , you might potentially save yourself plenty.

While money your wedding day might possibly be stressful, purchasing your wedding ring need not be! Start-off creating your own customized wood wedding rings and talk to your alive cam party to locate your band-associated inquiries answered.